Table of Content

- Why choose one-month car insurance?

- How much does home insurance cost by dwelling coverage amount?

- Can I buy normal home insurance for the short-term?

- Senior Financial Analyst (m/w/d) für das Financial Departement einer weltweit tätigen Rückversicherung

- Will I Get My Money Back If I Cancel A 12 Month Renters Insurance Policy?

- Most & least expensive zip codes for homeowners insurance in California

For example, if your $2,500 laptop is stolen and the claim is subject to a $1,000 deductible, you pay $1,000 and your policy will cover the remaining $1,500. The higher the deductible you select, the lower the premium you pay on your insurance. There are a few other coverages that are essential to any insurance policy, including liability protection. All policies protect most common personal property items including laptops, smartphones and furniture.

But most car insurance policies cover the odd trip by a driver who is not listed on the policy. For example, if your friend borrows your ride to make a grocery run for your big Fourth of July barbecue and causes a car accident, your insurance will more than likely cover that accident. In general, the more claims you've filed in the past, the higher your home insurance rates will be since companies view you as at greater risk of filing another claim. These rates don’t tell the full story, as they don’t take into account coverage add-ons or separate policies you may need to purchase for protection against earthquakes, wildfires, hurricanes, or windstorms. For example, while rates are extremely low in Hawaii, this doesn’t factor in the cost of separate hurricane insurance you’ll be required to purchase if you have a mortgage.

Why choose one-month car insurance?

Companies will reward you with savings for keeping all of your policies with them — and this can also make paying bills and filing claims easier. Trampolines, tree houses, and other “attractive nuisances” are a liability risk and having one on your property can result in higher premiums. If your kid moved off to college and you don't have any use for these structures anymore, consider removing them and you may just see lower rates. Did you pass down your prized heirloom to a grandchild or sell off a bunch of personal belongings? Then you might not need as much personal property coverage.

Examples would be Hotel & Air BnB expenses or reimbursment for your payments to a friend or family member to rent space in their home. Non-owner auto insurance usually doesn't include a deductible—the agree-upon amount you pay after an accident before your car insurance coverage kicks in. Of course, you should compare the difference in price and rental car insurance coverage between your credit-card company and your rental car company. When you do find an insurance provider that offers temporary coverage, you'll need to make sure you're able to use it for the full policy period.

How much does home insurance cost by dwelling coverage amount?

In this case, you’d be forced to find coverage through a specialty insurer or the Oregon FAIR Plan, which are both typically more expensive. For a policy with $300,000 in dwelling coverage, according to Policygenius's 2022 analysis of home insurance rates in every U.S. state and ZIP code. Over the last couple of years, the home insurance industry has had to deal with the compounding effects of rising construction costs, labor shortages, and record-high claim payouts due climate disasters. Because home insurance premiums are heavily influenced by home rebuild costs and natural disaster losses from prior years, insurers have had no choice but to file for rate increases in most states. Jennifer Gimbel is a senior managing editor and home insurance expert at Policygenius, where she oversees our homeowners insurance coverage. Previously, she was the managing editor at Finder.com and a content strategist at Babble.com.

Most companies have what’s called a “minimum earned premium.” That means that as soon as the policy is issued, a small portion of the cost is considered “earned” based on the fact that the policy existed at all. The exact amount will vary by company and by the time you’ve had the policy. So, if all you want is month-to-month coverage and you can't find what you're looking for, get a six-month policy and cancel early. Sure, it will cost you a little extra money to cancel early, but you'll be fully covered until then. If you do happen to snare a short-term auto policy, most insurers will ask for a down payment of at least one month and possibly two months of the total premium. If you cancel your short-term policy early, you might not get back your whole down payment.

Can I buy normal home insurance for the short-term?

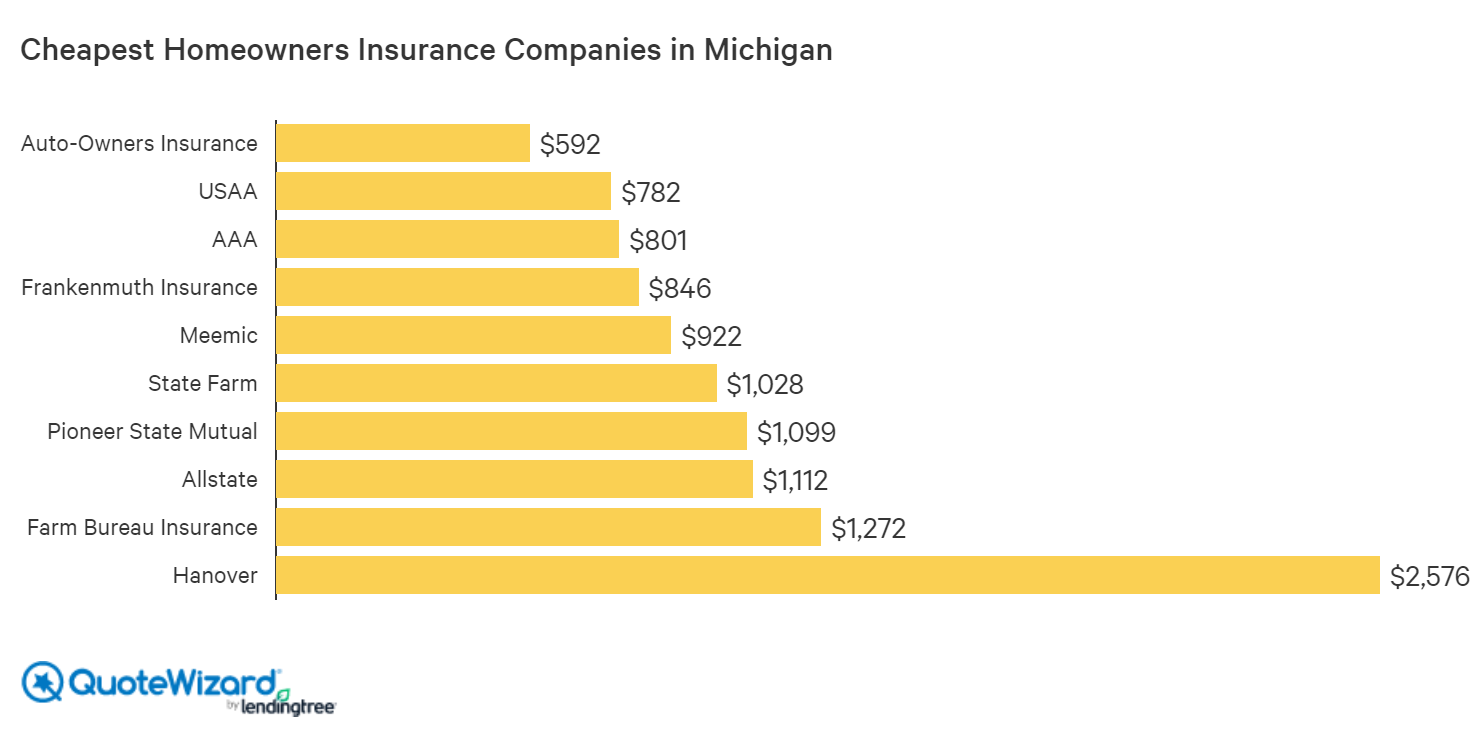

To find out which insurer offers the cheapest rates in your state,visit here. Your homeowners insurance might cost more than expected if your home is older, your region is at high risk for natural disasters or you have poor credit, among other factors. But every insurance company prices policies a little differently. So if you’re unhappy with your rate, get quotes from at least three other companies to see if you can find a better deal. We analyzed prices in the 20 largest metropolitan areas in the U.S. to find the average homeowners insurance cost in each city.

It’s easy to compare rates with our home insurance calculator. Just enter your ZIP code and a few coverage basic to see homeowners insurance quotes for your home. Because of this, full details of cover may differ depending on the insurer. Please double-check the policy wording before buying to confirm what your policy specifically covers. Our analysis found that the average home insurance cost is less than $1,000 in some states, including Hawaii, Delaware and Vermont.

Senior Financial Analyst (m/w/d) für das Financial Departement einer weltweit tätigen Rückversicherung

Dwellings you own have another coverage called "Loss of Rents". This coverage operates similar to ALE but covers the lost rental value you would be earning while the dwelling is unable to be rented or lived in. This coverage also covers an increased cost of items such as utility bills. ALE would cover the difference between the baseline utility bill and the new cost, indemnifying you from that additional expense.

However, if you have valuable items, such as fine art, musical instruments, or expensive jewelry, you may need an endorsement to cover them. The other critical coverage is for your belongings or personal property coverage. It's important to make an inventory of all the items you own so that you can determine how much personal property coverage you need. You only pay for the duration you want with no long-term contracts or renewals.

Normally insurance companies have partner organisations abroad where they can get assistance with tricky/suspicious cases. On a Homeowner's policy, the coverage is called "Additional Living Expense". Additional Living Expense covers the cost to rent a like kind and quality property after your insured property suffers direct physical damage from a covered cause of loss.

Based on our analysis of the cheapest home insurance companies, we found that Erie's average home insurance rate in the lowest, followed by Auto-Owners and USAA. According to the Insurance Information Institute, New Jersey has the highest average auto insurance rates, with an average cost of $109.11 per month. Idaho has the cheapest average car insurance rates, at an average cost of $49.98 a month.

The minimum tenure for temporary car insurance can be a few hours and can go up to 9 months depending upon the requirement of the customers. Borrowed Cars – Also known as non-owner car insurance, it is similar to rental car insurance, but for private cars. One can get insurance for a car borrowed from relatives, friends, etc for a short-term period.

Just choose how long you’ll be driving for, up to 1 month and get the cover you need fast. Where you live– The crime rates and traffic accident statistics of where you live, and drive will increase or reduce the price of your policy. Safer areas will be cheaper than those with high crime and accident rates.

No comments:

Post a Comment